FAQ

Welcome to the Rhodium FX FAQ page. Here you'll find answers to the most common questions about our forex prop firm, including details about our evaluation process, trading rules, platform, payouts, and support.

Rhodium FX is a forex proprietary trading firm that funds skilled traders with capital to trade the markets. We take on the financial risk so traders can focus on their strategies without using their own money.

To receive a funded account, traders must pass our two part evaluation challenge. This involves hitting a profit target while adhering to specific risk management rules. Once the evaluation is successfully completed, you’ll be given access to a funded account.

Our evaluation requires traders to reach a set profit target of 10% within a 90 day window. Key rules include maximum daily and overall drawdown limits. Exact parameters may vary depending on the account size and challenge type selected.

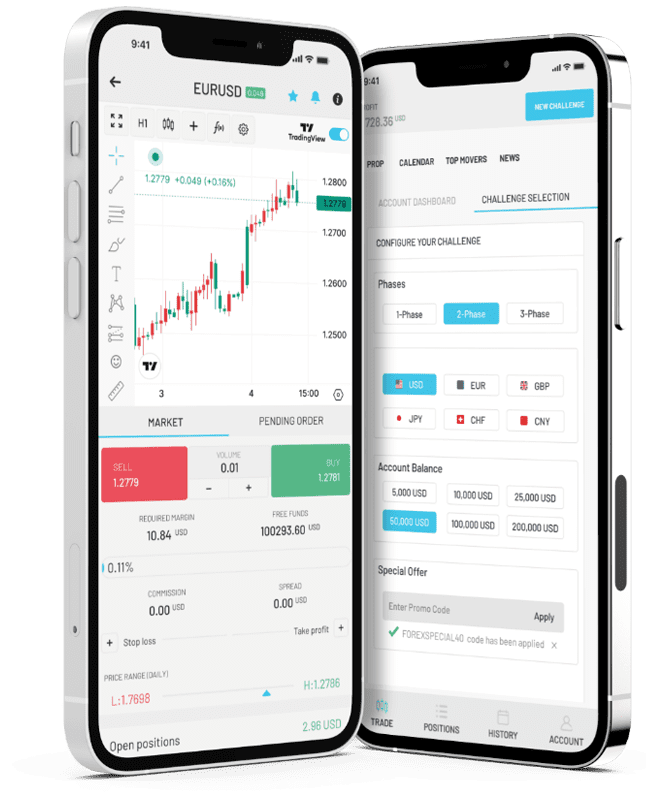

We offer funded account sizes ranging from $10,000 to $50,000. Your trading capital depends on the challenge you select and your performance during the evaluation.

Yes. Once funded, traders receive 80% of the profits they generate through trading. Payouts are scheduled regularly and can be withdrawn using several supported payment methods.

Rhodium FX exclusively supports Match-Trader, a modern, fast, and reliable trading platform with advanced charting tools and seamless execution. It is available on desktop and mobile for maximum accessibility.

Traders can access a wide range of forex pairs, as well as gold, silver, and major indices. A full list of tradable instruments is available inside the Match-Trader platform.

Yes. There is a one-time evaluation fee to enter the challenge. The cost depends on the account size you choose. This fee helps cover administrative and operational costs and is not refundable.

If you don’t pass the evaluation, you can try again by purchasing another challenge. In some cases, we offer discounted retries for returning traders who came close to meeting the objectives.

Absolutely. We encourage traders to use any strategy they prefer — including scalping, swing trading, or algorithmic trading — as long as it complies with our risk management rules.

We allow most trading styles; however, certain practices like copy trading, arbitrage, or exploiting platform latencyare not permitted. All trades must be made by the trader themselves.

Our support team is available 24/5 via live chat and email. Whether you need help with your account, the platform, or general questions, we're here to help quickly and effectively.